Payabill has decided to offer international trade finance effectively to this market segment.

Traditional lenders have neglected finance for small businesses due to the high costs associated with onboarding and assessing these customers, as well as managing their credit risk. In addition, small businesses do not meet the onerous credit requirements of banks and other specialized firms especially with respect to international trade finance.

Eli Michal, CEO of fast-growing fintech lender Payabill, explained:

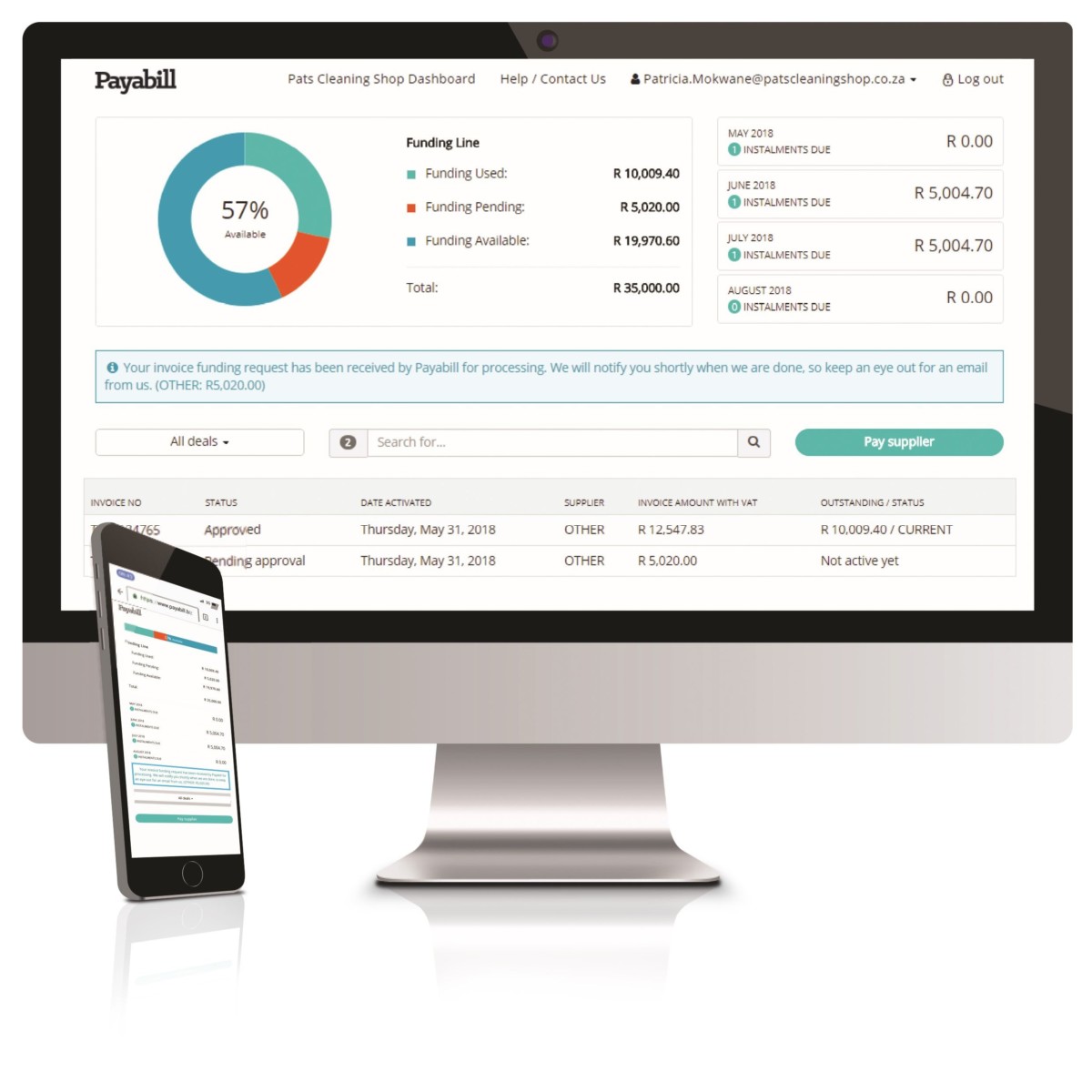

“We were established in 2017 and have been providing trade finance to SMEs by settling our clients’ suppliers directly and allowing clients to select their own extended payment terms. We had constant requests from SMEs for support to finance imports. We were able to collaborate with our equity partner’s Sasfin Forex division to develop a bespoke credit offering. It allows SMEs to access this vital funding to provide international working capital solutions to grow their businesses. Our offering is 100% digital, fast and compliant. Clients choose how often they wish to make payments and over what time period so that they don’t take on any additional strain.”

Michal notes that the eligibility criteria are very simple. “SMEs that are eligible for this type of finance have been operating for more than a year, are registered as a CC or Pty, and have an annual turnover between R500 000 and R30 million. Payabill International Trade Finance settles international suppliers from R5 000 up to R500 000 or higher.

Michal continues, “We take risk where it matters at the coalface of SA’s businesses by helping smaller businesses that have little security and struggle to get funding. We pay suppliers when sales aren’t yet guaranteed and take risks where no one else would consider it. We are intent on helping those businesses that are locked out of the market at a time when SA businesses need all the support that they can get.”