leading financial hub

The start-up Bling Card has announced developing a secure prepaid pocket money card combined with a financial education app for children and teens, in partnership with the renowned European fintech and leader in Banking-as-a-Service, Treezor. With the Bling Card, children and teens can pay independently and securely throughout Germany, including online. Thanks to the Bling […]

Enfuce has achieved the Amazon Web Services (AWS) Financial Services Competency. This will help financial institutions and fintechs to accelerate innovation, improve customer experience and manage critical issues pertaining to the industry, such as core system renewals, data management and navigating compliance requirements. “Since we founded Enfuce, AWS has been enabling and driving our growth. Achieving […]

nCino, a pioneer in cloud banking and digital transformation solutions for the global financial services industry, has announced that ‘champion for the North’ challenger bank GBB is live on the nCino Bank Operating System. GBB, which is currently in the process of gaining a banking license, will use nCino’s cloud-based commercial lending platform to process […]

Mastercard and Citi have announced a new partnership to support local residents and small businesses through greater public-private sector collaboration. Through City Possible, Mastercard’s partnership and co-creation framework for cities, the two global leaders will bring their collective resources, expertise, and integrated urban development frameworks to the City Possible network. The partnership will initially grant […]

The Munich-based technology and financial services provider Tangany has received a license from the German Federal Financial Supervisory Authority (BaFin). Tangany’s vision of combining market-leading and highly secure technology for the custody of digital assets with regulatory security is hereby confirmed by BaFin. Furthermore, Tangany plans to apply for further licenses in Germany and Europe […]

Sensibill, the only customer data platform designed specifically for the financial services industry, has announced the launch of its Invoice Extraction API. Sensibill’s advanced invoice extraction solution enables small businesses to upload paper and digital invoices seamlessly and quickly. Unlike other options in the market, the process is completely automated, helping small businesses like accounting […]

Veriff has announced that it has joined Visa Fintech Partner Connect to provide both fintechs and traditional issuers with a fully automated, AI-powered identity verification platform. By participating in the program, Veriff will offer bespoke identity verification experience to Visa’s expansive network of issuing clients, helping to stop fraud attempts and bad actors in their tracks […]

Switcho, an Italian digital fintech platform has upgraded its services by teaming up with Salt Edge. The partnership allows Switcho to provide insights on expenses and at the same time offer the chance to take actions about it, straight from the app, in order to save on those expenses. The liberty of providing various utility services, […]

LexisNexis Risk Solutions UK Limited, part of RELX, has acquired TruNarrative, which provides a cloud-based orchestration platform that detects and prevents financial crime and fraud. TruNarrative will become a part of the Business Services group of LexisNexis Risk Solutions. Founded in 2016 and headquartered in Leeds, UK, TruNarrative enables organisations to manage the entire financial crime lifecycle […]

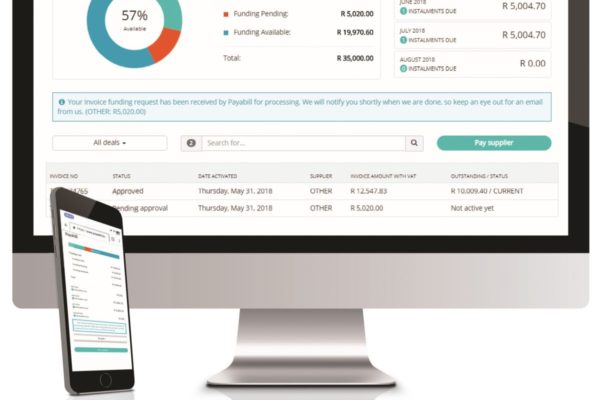

Payabill has decided to offer international trade finance effectively to this market segment. Traditional lenders have neglected finance for small businesses due to the high costs associated with onboarding and assessing these customers, as well as managing their credit risk. In addition, small businesses do not meet the onerous credit requirements of banks and other […]