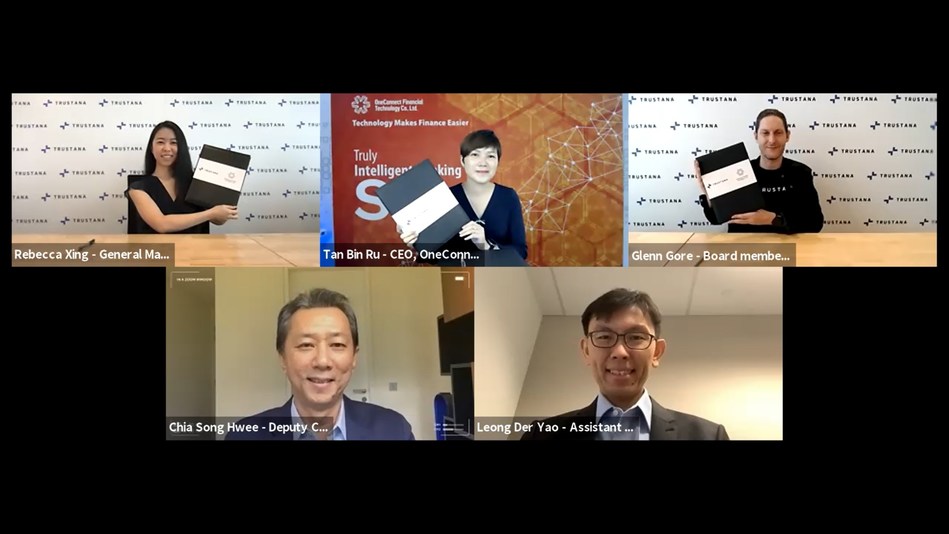

Trustana, a curated cross-border business-to-business (B2B) marketplace founded by Temasek, and OneConnect Financial Technology has announced a strategic collaboration to accelerate cross-border commerce.

Under this collaboration, Trustana will integrate OneSME, a digital cross-border trade platform, into its marketplace. Building on Trustana’s cross-border trade expertise and OneConnect’s core competencies in architecting technology solutions, curating and operating an extensive network of ecosystems in China, the collaboration will enable small and medium-sized enterprises (SMEs) in Singapore and ASEAN to access a larger pool of buyers in China, seize international trade opportunities, and benefit from value-added services on Trustana’s platform.

Trustana’s platform enables buyers and sellers to transact with greater trust and confidence. As a result of the collaboration, SMEs in Southeast Asia will be able to buy and sell their products directly to pre-screened buyers and suppliers in China who show keen interest , boosting the chances of a match. In addition, the collaboration will allow SMEs to have access to a buyer base of four million Chinese SMEs via OneConnect’s YiQiYe, a one-stop SME ecosystem that provides financing, insurance and cash management solutions to SMEs in China.

Trustana will also integrate with the Guangxi Open Finance Platform, a cross-border digital financial services platform led by Guangxi district government, and jointly built and operated by OneConnect and Digital Guangxi Group to promote collaborations between governments, institutions and enterprises. The strategic collaboration will strengthen Trustana’s growing presence in China as a buyer marketplace, and accelerate ongoing expansion to other trade corridors in ASEAN.

OneConnect, as the technology expert for financial institutions and ecosystem strategies, will provide Trustana buyers and suppliers with access to financial services products through OneSME’s first bank partner, UOB. UOB, which has received industry recognition for its efforts to help SMEs achieve their growth ambitions, will provide digital financing services as well as solutions that go beyond banking, helping SMEs seize cross-border opportunities.