Salt Edge has announced the launch of a new open banking solution on the European market – TPP Verification.

The solution simplifies ASPSPs’ efforts in checking the third-party providers trying to access users’ account data.

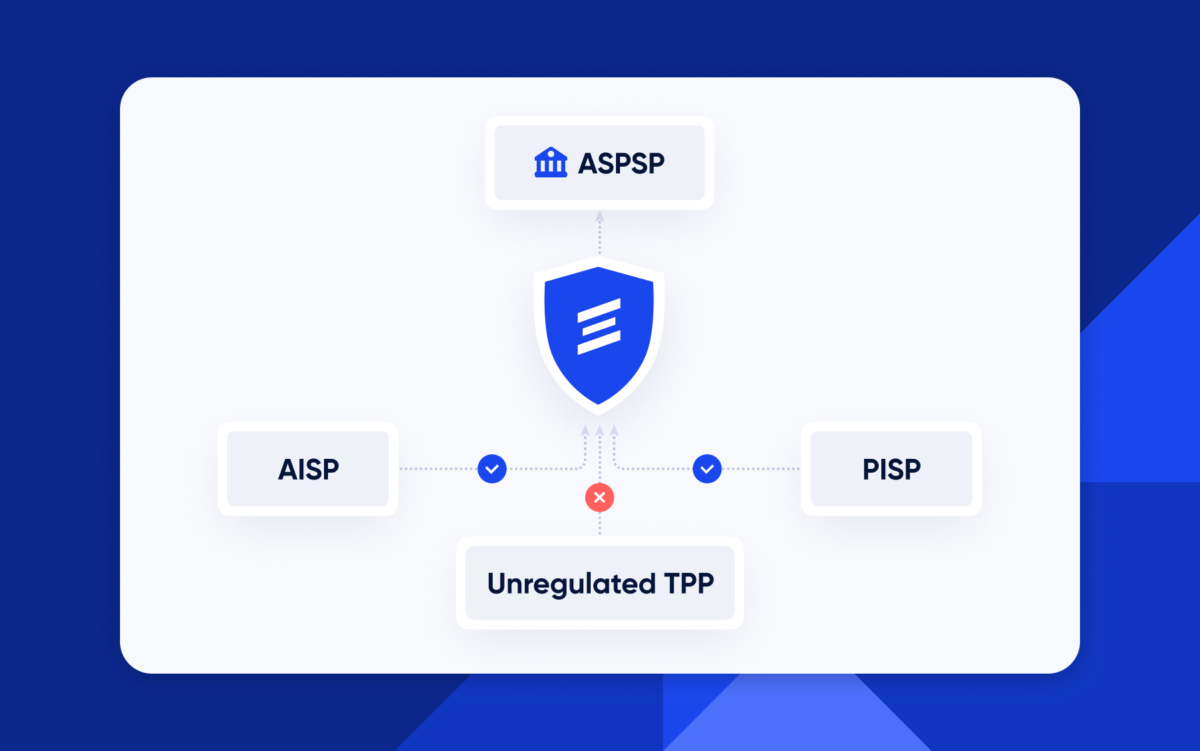

To keep customers’ accounts safe, ASPSPs are obliged by PSD2 to have a mechanism for TPPs to identify themselves before accessing the open banking channels. With the solution end-users can be certain that their data will be available exclusively upon their permission to legitimate and regulated TPPs, while banks and EMIs are assured that the corresponding risk is mitigated by Salt Edge.

Salt Edge is filling that gap with the in-house built, standalone solution dedicated to banks and EMIs – TPP Verification. Ticking the legal box for banks to verify the status of each TPP trying to gain access to their accounts, the newly launched solution takes the burden off financial institutions.

Salt Edge’s TPP Verification is available on the SaaS model and is easily deployed on ASPSP’s side within a couple of days, being compatible with both dedicated APIs and modified customer interfaces. The information is provided in a matter of milliseconds and includes data about TPP’s PSD2 role, issuing QTSP, passporting permissions, eIDAS revocation checks, and more.

Ana Maria Bahnarel, Project Manager at Salt Edge, said:

“Open banking’s success depends on innovation and collaboration, backed-up by serious investments in security. Instead of doing it alone, ASPSPs can team up with fintechs and collectively deliver greater solutions to everyday challenges. TPP Verification developed by Salt Edge does exactly what it promises: protects data and enhances payments’ security, making fraudulent activities impossible. We are keeping the fences as high as possible.”