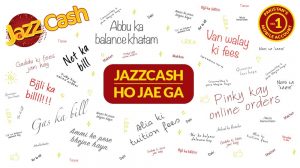

With the launch of the ‘Ho Jae Ga’ campaign, Pakistan’s leading cellular network Jazz has echoed the ease of access and reliability in financial transactions that its digital payment platform, JazzCash, offers to its valued customers.

With the launch of the ‘Ho Jae Ga’ campaign, Pakistan’s leading cellular network Jazz has echoed the ease of access and reliability in financial transactions that its digital payment platform, JazzCash, offers to its valued customers.

As virus lockdowns in the country lead to a reduction in mobility, JazzCash is enabling people to make bill payments, money transfers, and mobile loads all from the comfort of their homes while ensuring physical distancing in these risky times.

The digital payments platform has been to enable its customers with a smooth and convenient flow of finances. From traffic challan payments, tickets, school fee payments, to transactions via QR codes, remittances, and corporate disbursements, JazzCash offers it all with a steadfast promise – ‘Ho Jae Ga’, narrating the trust JazzCash customers have in the brand.

JazzCash also extends its services to merchants operating throughout the country, ensuring easy access and reliability in accepting digital payments. These include both retail merchants who can accept payments through JazzCash QR, as well as online merchants who can utilize the payment gateway solution to accept payments from their customers.

Not only do merchants get access to payment instruments, but they can also sign up for their merchant accounts, using Pakistan’s first digital onboarding solution through the JazzCash website.

“JazzCash has been leading the transformation of the local cash-based economy by offering innovative, convenient, and reliable products. However, the journey does not stop here. We are doubling down in our efforts to ensure JazzCash’s digital payment solutions reach millions, so we can successfully bridge the prevalent banking divide,” commented Erwan Gelebart, CEO at JazzCash.

In the current times, Gelebart added, what JazzCash offers is an efficient and secure way for its merchants to incorporate smart payments in their cash dealings, with a minimal chance of physical contact.

Pakistan’s digital landscape has massively expanded in a very short time, while Jazz continues to facilitate its customers with viable solutions during the COVID-19 pandemic. Digital payment platforms like JazzCash have proven themselves to be vital tools to drive social and economic progress.

With more than 165 million mobile phone users and 70 million 3G/4G subscribers across the country, JazzCash paves the way for business owners and customers to find a safer alternative to cash transactions, and improve their quality of life in these turbulent times. It has seamlessly bridged the country’s banking divide and strengthened the local financial ecosystem, and continues to do so.