UOB has launched TMRW, UOB’s award-winning ASEAN digital bank.

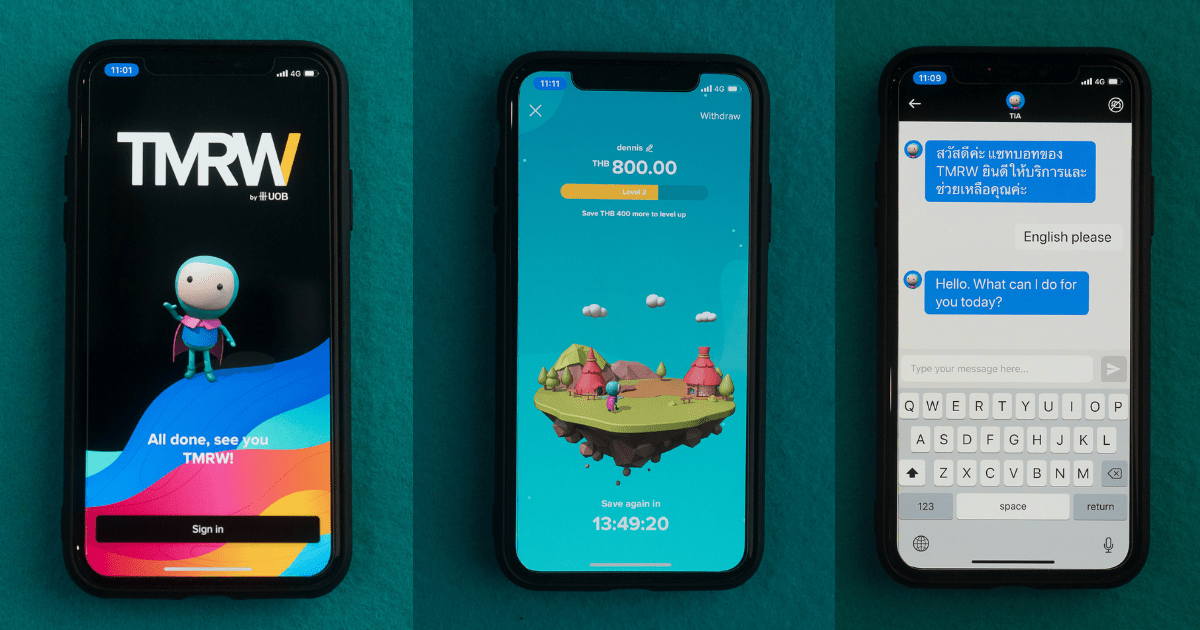

TMRW translates transaction data into actionable insights such as providing fun prompts to help customers save and spend better. This unique insights feature draws from a combination of artificial intelligence and complex data analytics and categorization, solving the need of 92 percent of consumers who want a banking solution to help them make wiser financial decisions.

UOB’s unique combination of innovation and customer-centricity enables TMRW to personalize the customer experience by anticipating an individual’s needs, conversing with them meaningfully, and serving them in ways that they want. TMRW’s language is also free from banking jargon and is easy to understand.

Kevin Lam, President Director, UOB Indonesia said, “Indonesia is home to a large base of young, enterprising and digitally-savvy consumers. Ninety-six percent of Indonesians own a mobile phone and the number of consumers who are connected to the internet has steadily increased over the years2. The next generation of Indonesia’s changemakers are mobile and want on-the-go digital services that enable them to achieve their aspirations. With TMRW, we hope to help them meet their financial goals and to support them as they build a better tomorrow.”

TMRW also offers Quick Response (QR) code payments, enabling fast and convenient payment to registered sellers and merchants simply by scanning a QR code. This feature is part of UOB’s strong support for the National Non-Cash Movement using the Quick Response Code Indonesian Standard (QRIS) as the platform.