Telenor Microfinance Bank

Easypaisa, Pakistan’s leading digital payments app, has partnered with the Bank of Khyber to ensure seamless distribution of funds to beneficiaries in KPK under the Insaf Food Programme. Through the strategic partnership, beneficiaries of the programme will be able to receive PKR 2100 every month in their Easypaisa mobile wallet or collect cash from any […]

37 entrepreneurial champions from the rural areas of Pakistan have been honored at the 14th Citi Microentrepreneurship Award (CMA) ceremony, jointly hosted by the Citi Foundation and Pakistan Poverty Alleviation Fund (PPAF). The recipients of the Awards from all geographical localities of Pakistan have shown remarkable entrepreneurial skills by availing the microfinance facility through various […]

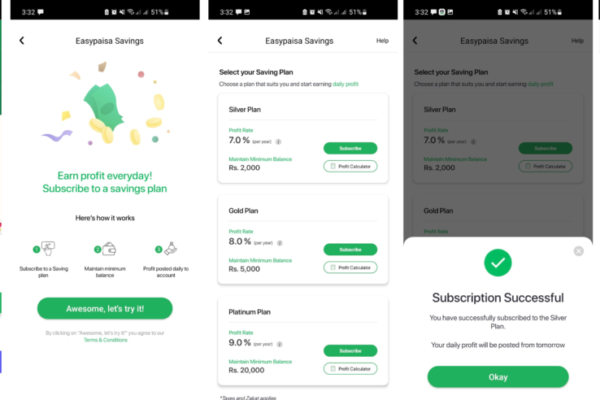

Easypaisa, Pakistan’s leading digital payments platform, has introduced yet another innovative feature enabling users to earn daily profits through a single click. Easypaisa users can now use the in-app savings product to earn a percentage on their existing account balance every day. The revolutionary product is designed to financially empower all Pakistanis to take control […]

Easypaisa, the country’s leading digital payments App, has introduced an innovative feature that enables users to upgrade their mobile wallet accounts through in-app biometric verification. A key regulatory requirement, Biometric Verification System (BVS) also enhances users’ daily, monthly and yearly transaction limits. Customers will now be able to use the BVS feature to upgrade their […]

Easypaisa, Pakistan’s leading digital payments platform, has partnered with Munsalik Digital (MDPL) to streamline the latter’s operational capabilities. Through this partnership, Munsalik will be able to disburse and collect loan repayments through Easypaisa’s widespread branchless banking network, thereby introducing efficiencies, process standardization, and improving the customer’s journey. MDPL has been digitizing the customer on-boarding process […]

Telenor Microfinance Bank, the operator of Pakistan’s leading digital payments platform Easypaisa, has gone live on Temenos’ modern core banking platform with NdcTech to power its digital banking services. By employing Temenos’s best-in-class solution and NdcTech’s implementation expertise, Telenor Microfinance Bank will be able to innovate faster and provide customers with much-needed access to digital […]

Easypaisa has partnered with DigiKhata, an emerging bookkeeping service, for merchants and retailers to enable the collection, disbursements, and record-keeping of payments amongst on-boarded merchants and their suppliers. Easypaisa will facilitate DigiKhata through its payments mechanism by integrating API (Application Programming Interface) use cases allowing them to collect funds from a list of registered merchants […]

As the new year brings with it hope for better times to come, Telenor Microfinance Bank has taken it as an opportunity to further strengthen its ambition to enable a truly digital Pakistan. The Bank remains steadfast on a mission to transform Pakistan into a cashless and financially inclusive society through the power of collaboration […]

Easypaisa, Pakistan’s flagship digital payments platform has joined hands with NADRA Technologies Limited (NTL) to provide cross-platform services on NADRA e-sahulat networks enabling convenient access to digital financial solutions. Under the partnership, all 12,000 NADRA e-Sahulat centers across the country will now also provide a host of Easypaisa services. The agreement was signed by Khurram […]

Telenor Microfinance Bank, the first scheduled microfinance bank of Pakistan and the operator of the country’s leading digital payments platform Easypaisa has received an investment of US$45 million from its shareholders Telenor Group and Ant Group Co., Ltd. (Ant Group). The investment by the shareholders has further strengthened the Bank’s capital position and placed the […]