payables finance solution

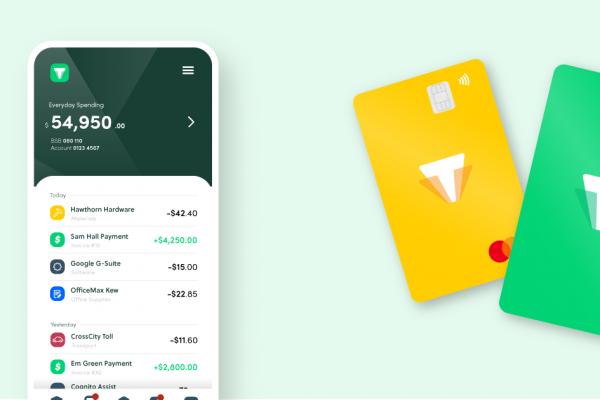

Thrive has announced a new partnership with Mastercard as it prepares to launch a new business account targeting Australia’s 2.3 million small businesses. Thrive has developed a unique product that uses artificial intelligence to automate banking, accounting, tax and lending for small-to-medium businesses. Whilst Thrive continues to gear up for the introduction of its business […]

VEON has announced a strategic global partnership with Mastercard to boost digital financial services in key markets. The partnership will allow VEON to further scale its digital financial services business by offering consumers and merchants in these countries best-in-class products tailored to their needs. By working together, the companies will support the financial and digital […]

Mastercard launched its Global Cyber Forward program in partnership with Dubai International Financial Centre (DIFC), the leading global financial center and largest fintech hub in the Middle East, Africa and South Asia (MEASA) region. The Global Cyber Forward program combines Mastercard’s cutting-edge capabilities in cyber security with those of leading public sector organizations to create secure […]

German digital bank N26 has received a banking licence from the Brazilian Central Bank. N26 has received a Sociedade de Crédito Direto (SCD) licence from the Brazillian regulator, which will allow the fintech to carry out credit operations such as third-party credit analysis and the ability to issue electronic currency. The fintech has announced plans to launch […]

Form3 has secured a partnership with and investment from Mastercard to help banks and financial institutions around the world connect with domestic and international payment platforms more seamlessly, reliably and securely. The additional funding follows $33m raised in August this year from new investors; Lloyds Banking Group, Nationwide Building Society and venture capital firm 83North. […]

Wahed Inc. has announced that it will acquire Niyah Ltd, a UK-based fintech that is creating a banking app and ethical financial platform catered to the Muslim community. Wahed’s acquisition of Niyah will honour the firm’s commitment to service the UK market by offering customers access to interest-free financial products including digital bank accounts, debit […]

tabby has announced that it has raised Series A financing of $23m in debt and equity led by Arbor Ventures and Mubadala Capital, with participation from STV, Raed Ventures, Global Founders Capital, JIMCO, Global Ventures, Venture Souq, Outliers VC, MSA Capital, HOF and Arab Bank. This funding will fuel the company’s next stage of growth, […]

finleap welcomes a new addition to its portfolio – The company “deineStudienfinanzierung” becomes part of the finleap family through investment. The platform enables all students to study without financial worries. The platform aggregates the largest financing products – from long-term to daily needs – for studies. University students can determine their individual entitlement to options such as […]

Scotiabank has launched a new Global AI Platform that provides customers with intelligent and personalized financial advice. The platform is enabling the Bank to provide fast, relevant advice by anticipating and understanding customers’ needs. It is being used to operationalize several customer models into its retail banking businesses across the Americas. The platform’s compute power enables […]

Singapore-based fintech company, Lightnet Pte. Ltd. (Lightnet Group), has announced a partnership with Siam Commercial Bank (SCB). The partnership makes remittance services accessible to all Thai bank accounts and anyone who has signed up for PromptPay, a government-sponsored service that enables instant bank-to-bank fund transfers. Suvicha Sudchai, Chief Product Officer of Lightnet Group says, “SCB will be […]