financial services technology

The Munich-based technology and financial services provider Tangany has received a license from the German Federal Financial Supervisory Authority (BaFin). Tangany’s vision of combining market-leading and highly secure technology for the custody of digital assets with regulatory security is hereby confirmed by BaFin. Furthermore, Tangany plans to apply for further licenses in Germany and Europe […]

Sensibill, the only customer data platform designed specifically for the financial services industry, has announced the launch of its Invoice Extraction API. Sensibill’s advanced invoice extraction solution enables small businesses to upload paper and digital invoices seamlessly and quickly. Unlike other options in the market, the process is completely automated, helping small businesses like accounting […]

Veriff has announced that it has joined Visa Fintech Partner Connect to provide both fintechs and traditional issuers with a fully automated, AI-powered identity verification platform. By participating in the program, Veriff will offer bespoke identity verification experience to Visa’s expansive network of issuing clients, helping to stop fraud attempts and bad actors in their tracks […]

Switcho, an Italian digital fintech platform has upgraded its services by teaming up with Salt Edge. The partnership allows Switcho to provide insights on expenses and at the same time offer the chance to take actions about it, straight from the app, in order to save on those expenses. The liberty of providing various utility services, […]

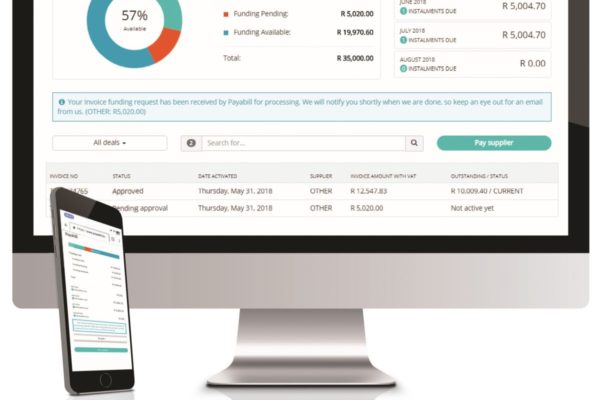

Payabill has decided to offer international trade finance effectively to this market segment. Traditional lenders have neglected finance for small businesses due to the high costs associated with onboarding and assessing these customers, as well as managing their credit risk. In addition, small businesses do not meet the onerous credit requirements of banks and other […]

Liberis has announced that it has been selected by Klarna to provide additional financial services to Klarna merchants. Klarna, one of Europe’s most valuable private technology companies, provides 250,000 merchants in 17 countries with a checkout and payment suite that enables their consumers to “buy now and pay later”. Now, through Liberis, Klarna can also offer its […]

Fiserv, a leading global provider of payments and financial services technology solutions, and NYDIG, a leading bitcoin technology and financial services company, has partnered to help financial institutions of all sizes to allow consumers to buy, sell and hold bitcoin through their bank accounts. This will enable banks and credit unions to meet growing mainstream […]

Vivid has partnered with Yapily to offer its customers a free top-up feature via Open Banking. Vivid will make it easier and more convenient for customers to transfer money from almost any bank account to their Vivid pocket. Customers will not need to enter their details manually every time they wish to transfer money from now on […]

FinTech scale-up AccessPay has partnered with Open Banking infrastructure provider Yapily to launch a new Treasury solution for corporates. The integration enables AccessPay users to connect and aggregate their entire corporate banking estate at the click of a button. This decreases the time-to-value for corporates from months to minutes. The ability to join together data from […]

IDEMIA has announced that it is collaborating with Microsoft to support its new Microsoft Azure Active Directory (Azure AD) verifiable credentials identity solution. Azure AD verifiable credentials enable organizations to confirm information about individuals, such as their education, professional or citizenship certifications, without collecting or storing their personal data. Verifiable credentials can replace all kinds […]