digital transformation strategy.

SEON, the fraud fighters, has announced that its fraud detection and prevention app is now available on Shopify. SEON’s new app delivers smarter, easier fraud checks to help reduce chargebacks, lost payments and goods, and smarter fraud checks powered by AI and machine learning to Shopify’s 1.75 million merchants globally. With no technical or fraud […]

UK, London – End-to-end e-SIM management and distribution solution provider, NetLync, has signed a strategic partnership agreement with global ID verification service provider Shufti Pro to enable secure and seamless customer onboarding for mobile network operators. Joining in on Shufti Pro’s vision to streamline identity verification and customer onboarding, NetLync will be employing Shufti Pro’s […]

Equifax has announced the launch of its new Digital Identity as a Service capability as well as an Innovation Partnership with Bonifii as a first adopter of the new solution. Equifax Digital Identity as a Service combines data and analytics with modern cryptography to provide a higher degree of trust without sacrificing user experience. Adding Digital Identity as […]

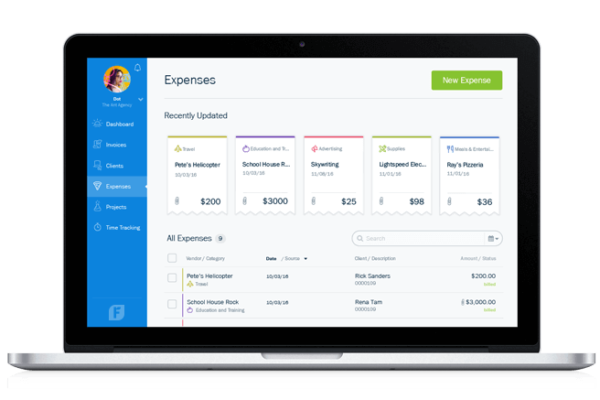

FreshBooks, a leading cloud accounting software provider, has announced the acquisition of FastBill, one of Germany’s leading cloud accounting and invoicing software solutions. FastBill helps self-employed professionals, small businesses, and startups maintain better control of their finances through electronic invoice management, reporting, and access to tax advisory services. The terms of the transaction have not […]

Entersekt has partnered with BankID to provide Norwegian banks with secure in-app and browser authentication, supporting requirements for digital identity, e-signatures and strong customer authentication on a single platform. The collaboration between BankID and Entersekt enables Norwegian banks to onboard customers using BankID, adhering to all Know Your Customer and Anti Money Laundering (KYC/AML) requirements. […]

Selecta has partnered with Fiserv to commence the enhancement and streamlining of digital payments across its points of sale, meeting consumer demand and boosting operational efficiency as self-service technologies. Selecta’s vision is to have a ONE Selecta technology solution that will support cashless interactions across its operations and enable future development and integration. The company […]

i2c has announced they are working with Visa, the world’s leader in digital payments, to launch point of sale installments capabilities for their participating issuers in North America. Visa Installments is a payment technology created by Visa that enables issuers to offer installment plans for their cardholders under their existing credit account lines, and for […]

SunTec Business Solutions has launched Xelerate on Salesforce AppExchange, empowering banks and financial services companies to build and deepen customer relationships, drive employee efficiency, and acquire new customers through data-driven insights. The platform can help banks to offer an enhanced customer experience and reduce time-to-market with real-time insights on customers, products, deals, prices and offers. […]

Sensibill has announced partnership with CAARY, a new credit and financial platform for small and medium-sized enterprises, to offer seamless, end-to-end financial services. Targetting the more than 800,000 Canadian SMEs that still don’t have access to business credit, CAARY offers them the support they need. With Sensibill’s solution, they can leverage AI and machine learning […]

Computer Services has announced the launch of CSI Loan Marketplace, a cost-effective digital solution that enables financial institutions to optimize their loan portfolios by accessing a nationwide market of commercial and consumer loans. The new offering connects financial institutions through a centralized platform, enabling them to buy, sell and participate in loan transactions of any […]