banking platform

Azentio Software, a Singapore-headquartered technology firm owned by funds advised by Apax Partners, announced that iMAL™ R14.6, the latest version of the company’s Islamic core banking platform, has successfully gone through the annual compliance exercise and received the certification for the year 2023 from the Accounting and Auditing Organization for Islamic Financial Institutions – AAOIFI, the […]

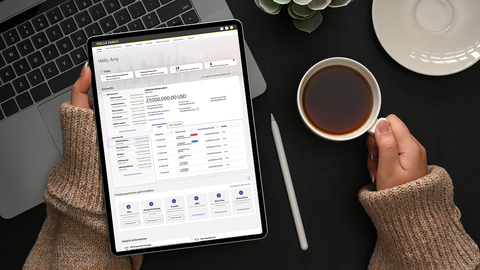

Wells Fargo & Company unveiled Vantage℠, a new digital banking platform for Commercial Banking and Corporate & Investment Banking clients. Previously known as the Commercial Electronic Office® – or CEO® Portal – Vantage℠ offers enhanced features to drive a more personalized experience through artificial intelligence (AI) and machine learning (ML) that meet the financial needs […]

Temenos announced that Mbanq, one of US’s leading Banking-as-a-Service (BaaS) providers, has expanded its relationship with Temenos to accelerate BaaS adoption in the US. The agreement deepens the companies’ collaboration after last year’s launch of a joint Credit Union as-a-Service offering (link). Temenos has also made a minority investment in Mbanq to capture the BaaS market which […]

Faysal Bank Limited (FBL) and Bank of Khyber have partnered to launch a suite of digital financial services featuring virtual & debit card services along with added digital payment solutions. Faysal Bank through its Fintech Express Program is driven by creating partnerships with Banks and Fintech to further encourage State Bank of Pakistan’s (SBP) financial […]

Invest Bank, a premier commercial bank in UAE, has selected Temenos to take its digital and core banking to the cloud, in partnership with NdcTech. Invest Bank will adopt an end-to-end retail and wholesale banking solution on the Temenos Banking Cloud, becoming one of the first in the UAE to adopt a full SaaS model […]

Atlanticus Holdings Corporation, a financial technology company enabling bank, retail and healthcare partners to offer more inclusive financial services to millions of everyday Americans, announced the launch of the Aspire® Banking platform: a first-of-its-kind banking program that puts the financially underserved on a clear path to being granted credit. Geared towards the nearly 44 million […]

Wio Bank, the first platform bank regulated by the Central Bank of the United Arab Emirates (UAE), has announced its successful go live on Mambu. Mambu’s cloud-native banking platform enables Wio Bank to achieve a faster time to market as it helps establish the UAE as a hub for the growing digital economy. Wio Bank […]

The Social Loan Company announces its transformative TLSC Platform Services will go live in Africa in Q1 2023 through two game-changing partnerships in Nigeria to improve financial inclusion in the region. Deepak H. Saluja, Co-Founder & Group CEO at TSLC, said: “Financial exclusion negatively impacts the lives of over 50% of adults in Africa. Despite massive […]

UnionBank continues the digital transformation of its wealth management business with the Avaloq Core Platform. This will help the bank to stay ahead of the technology curve as the financial industry continues to digitalize in the pursuit of greater efficiency and innovation. Avaloq is implementing its core banking system at UnionBank, a digital trailblazer in […]

Mambu, a leading cloud banking platform, announced a global partnership with Visa in order to utilise Visa DPS – one of the largest processors of Visa debit transactions globally. The partnership will give Mambu customers a seamless connection to Visa DPS for end-to-end card issuing and processing. Both companies recognised the importance of interconnectivity to […]