SmartCrowd, a UAE-based digital real estate crowdfunding platform, has introduced the MENA region’s first-ever secondary sales market, allowing investors to buy and sell their property shares securely.

A much-anticipated addition to the SmartCrowd platform, the aim of the secondary market is to provide more liquidity to investors who wish to exit property investments early, as well as give investors the chance to purchase shares from other investors in high-performing properties.

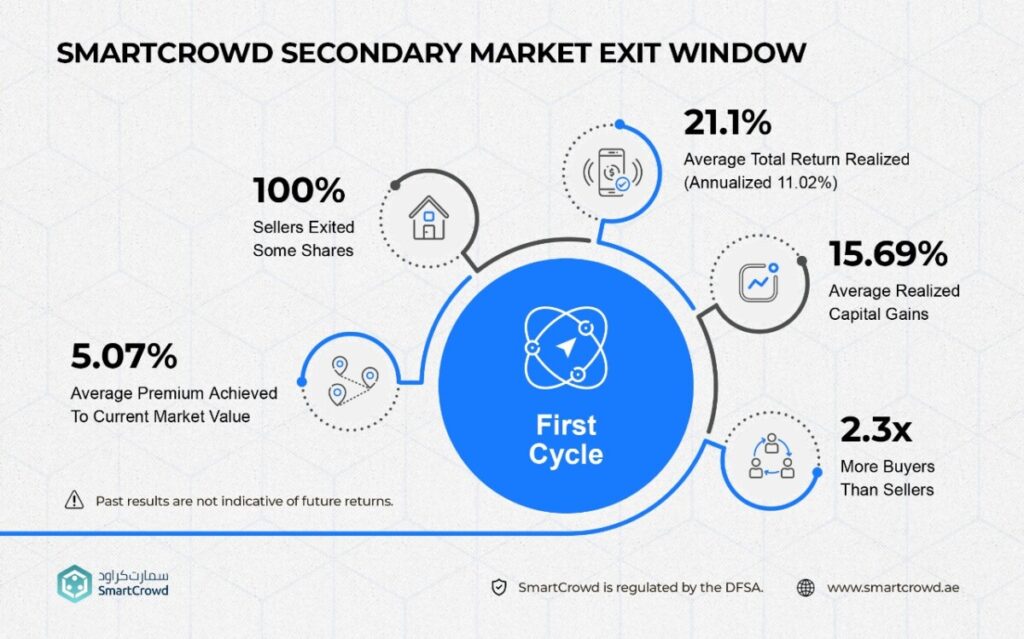

Siddiq Farid, CEO and Co-Founder of SmartCrowd, said: “What’s both exciting and important for us is that not only have we enabled people to make micro-investments, but investors can now realize their gains on the secondary market. In fact, all sellers on the secondary market were able to sell some of their shares listed.

“Overall, the success of our secondary market shows that those in need of liquidity can access their funds more readily, while investors looking to increase their exposure are able to buy shares in a convenient, transparent manner. Our secondary market structure offers investors more control, allowing them to manage their portfolio and plan their exits more appropriately. More importantly, it’s never been done before in the region, so being the first ones to make this possible is a major milestone for our organization. We fundamentally believe this is the future of real estate investing and encourage everyone to become part of the SmartCrowd community.”

After rigorous testing to ensure the best possible experience for its users, the secondary market, set to be operational twice a year, was launched in August 2022. Sellers realized an average total return of 21.1% comprising both rental income and capital gains from their exits. Buyers also took full advantage of this opportunity, outnumbering sellers 2.3 times over.

Mitesh Modi, a SmartCrowd investor who participated in the secondary market, said: “Buying and selling properties is now easier than ever before. The secondary market provides a unique opportunity to buy or sell property shares.

“One can book the capital gains or liquidate them should one want to invest in other properties. It’s user-friendly, transparent, and as easy as trading stocks. SmartCrowd truly empowers investors to be a part of the real estate growth journey in the region.”

Errol Dourado, a SmartCrowd investor who also took part in the Secondary Market, said: “The secondary market is a huge step towards solving the liquidity challenge and a gamechanger for SmartCrowd investors. The fact that I have more control over my investment gives me greater confidence in the real estate investing space and I’m eager to see what SmartCrowd does next.”

Previously, lack of liquidity in real estate has been a significant deterrent, discouraging mainstream investments into the asset class. The launch of SmartCrowd’s secondary sales market represents a significant step towards overcoming illiquidity, encouraging both new and veteran real estate investors to confidently invest in Dubai fractional real estate through the SmartCrowd platform.

SmartCrowd Limited is a DIFC-registered, DFSA-regulated platform that was launched in 2018 by Siddiq Farid and Musfique Ahmed, and is a wholly owned subsidiary of SmartCrowd Holding Ltd, a Hub71 company. Since its inception, the market-disrupting platform has crowdfunded more than 75 properties and has distributed over AED 4.0 million in rental income, establishing a strong investor base that continues to grow rapidly.

The company recently recorded its first exit on a Dubai Marina property that delivered 39.25% total returns over a 17-month period, demonstrating a complete investment cycle. Upon the successful launch of the secondary market, SmartCrowd has proven that liquidity is possible for investors looking to access their funds, though past results are not indicative of future outcomes.

Real estate investments have become even easier and more accessible with the SmartCrowd mobile application, now available on iOS App Store and Google Play.