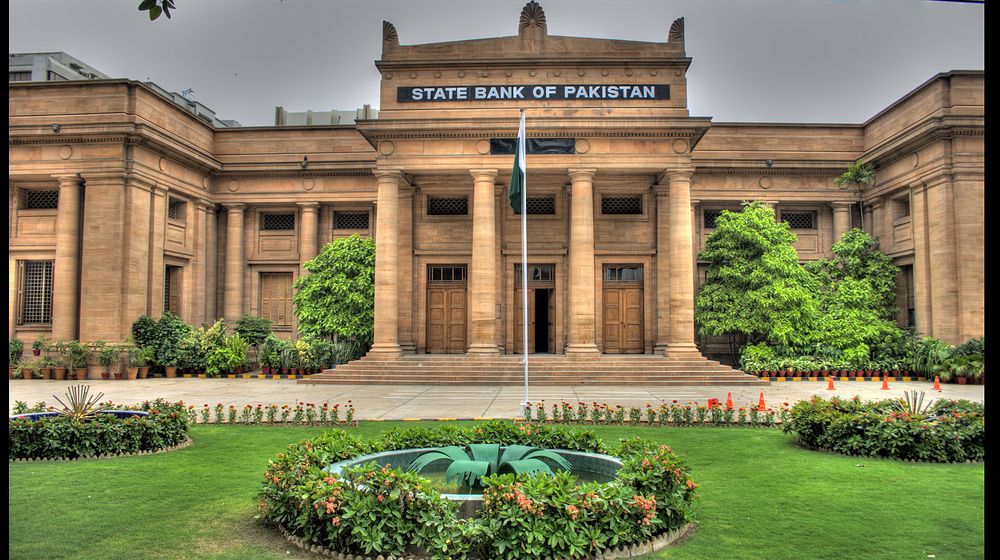

The State Bank of Pakistan, in a meeting of the Monetary Policy Committee (MPC) on Friday, reduced the policy rate by 100 basis points to 8 percent.’

This decision reflected the MPC’s view that the inflation outlook has improved further in light of the recent cut in domestic fuel prices. As a result, inflation could fall closer to the lower end of the previously announced ranges of 11-12 percent this fiscal year and 7-9 percent next fiscal year.

“Easier monetary policy … can provide liquidity support to households and businesses to help them through the ensuing temporary phase of economic disruption,” the SBP said.

This is the fourth time in three months that the SBP has slashed the policy rate. In the space between March 17 and May 15. On March 17 t cut the policy rate by 75 basis points to 12.5pc and on March 24further 150 basis points to 11pc were reduced.

The overall policy rate has been reduced by 5.45 percent from 13.25 percent, which is a significant cut in such a short span of time.

The latest rate cut “reflected the monetary policy committee’s view that the inflation outlook has improved further in light of the recent cut in domestic fuel prices”, the bank said.

“As a result, inflation could fall closer to the lower end of the previously announced ranges of 11-12pc this fiscal year and 7-9pc next fiscal year.”

The MPC noted the swift and forceful monetary easing of 525 basis points in the two months since the beginning of the crisis and SBP’s measures to extend principal repayments, provide payroll financing, and other measures to support liquidity. Together with the government’s proactive fiscal stimulus―including targeted support packages for low-income households, SMEs, and construction―as well as assistance from the international community, these actions should provide ample cushion to growth and employment, while also maintaining financial stability. This coordinated and broad-based policy response has provided relief and stability and should provide support for recovery as the pandemic subsides.

The MPC noted three key developments since the last MPC meeting on 16th April 2020. First, the government has significantly reduced petrol and diesel prices by 30-40 percent in response to the continued fall in global oil prices, which has improved the outlook for inflation. Second, most countries, including Pakistan, have begun easing lockdowns, which should help provide support to economic activity. Nevertheless, as elsewhere, the situation remains highly uncertain. A possible rise in infections could prompt fresh lockdowns, and the recovery could prove more sluggish than is currently being anticipated. Third, due to timely policy actions and international assistance, the initial volatility observed in domestic financial and foreign exchange markets has somewhat subsided in recent weeks, although global financial conditions remain considerably tighter than before the coronavirus outbreak. Recent supportive developments have helped to restore the SBP’s foreign reserves position to close to pre-coronavirus levels of over US$ 12 billion.