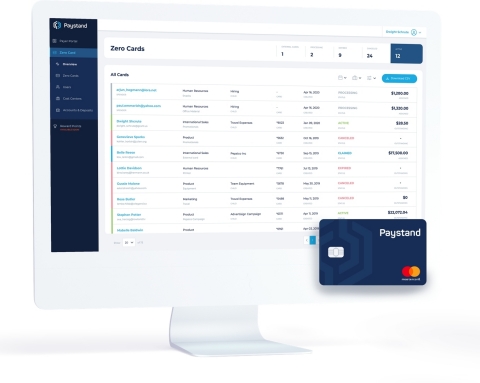

Paystand rolled out its new Zero Card, a touchless, pre-paid, digital corporate expense designed for mid-market businesses that need more flexibility and control over budgets and spending.

Zero Card allows businesses to manage, track, and control company spending in real-time. But unlike any corporate card on the market, the Zero Card leverages Paystand’s zero-fee payment network to give businesses a fast, secure way to eliminate the cost of transaction fees.

A key goal of the virtual Zero Card is to give companies better control over their spending.

“The Zero Card combines the consumer-like experience of peer-to-peer payments with the speed and security of Paystand’s no-fee payment network,” said Jeremy Almond, CEO of Paystand. “We completely re-engineered the corporate card so businesses can move away from reactive spend management tactics to a place where they have visibility of spend before it happens.”

Corporate employees can use the virtual card to make purchases online or over the phone, but without the hassle of credit checks and with no fees. Businesses can both issue and deactivate the 16-digit card number “in just a few clicks”.

“The current economy has sparked a dramatic focus on working capital. For payments to flow seamlessly, businesses need to move toward cashless digital systems,” said Mitch Kitamura, Managing Director at DNX Ventures. “Paystand’s Zero Card is a critical step for connected commerce and will help unlock cash flow for businesses and move the economy forward.”

“B2B payments needs revolution, not evolution. It has a long way to go before it achieves the ease and speed of consumer payments,” said Mark Fisher, Paystand’s VP of Marketing. “The Zero Card is the only solution designed for both AP and AR. It natively connects these two groups, bridging the gap for B2B payments to deliver impact beyond cost savings.”

Earlier this year, Paystand raised a $20 million Series B led by top-tier investors in order to scale its AR products and make it easier for businesses to collect and send money. As part of that, CEO Jeremy Almond made a commitment to expand Paystand’s payment network and give businesses new, digital channels to make zero-fee payments.