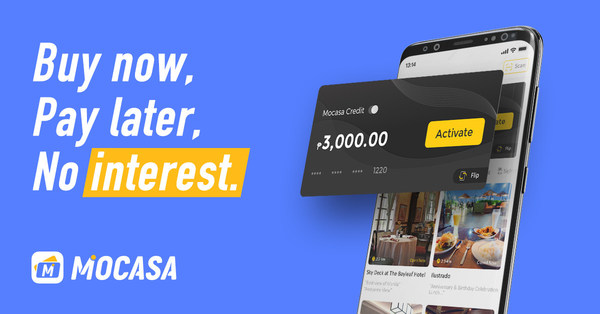

Mocasa, an international fintech platform, has launched its signature Buy Now Pay Later (BNPL) services in the Philippines in December 2021, providing consumers with a mobile payment option.

Mocasa adjusts the credit line based on analysis of user daily purchases and repayment behavior, to help users manage a healthy budget and form good repayment habits.

To activate Mocasa credit, users need to go through an easy Know-Your-Customer (KYC) process and get approved in as fast as one second. Unlike most credit providers, Mocasa ensures most users will be granted a credit line to start building their credit profile.

While Mocasa BNPL helps relieve consumers’ financial pressure, it also benefits merchants. It serves as a great venue for businesses to expand sales. The company is experienced at acquiring millions of daily active users.

“Mocasa aims to disrupt the credit card industry by enabling credit services to the majority of Filipinos,” said Julien Chien, Mocasa COO. “We observed the majority who deserve better financial services are being kept outside traditional financial institutions. Mocasa makes sure most users in the Philippines receive a credit line and helps them build a life-time credit profile with a good repayment history.”