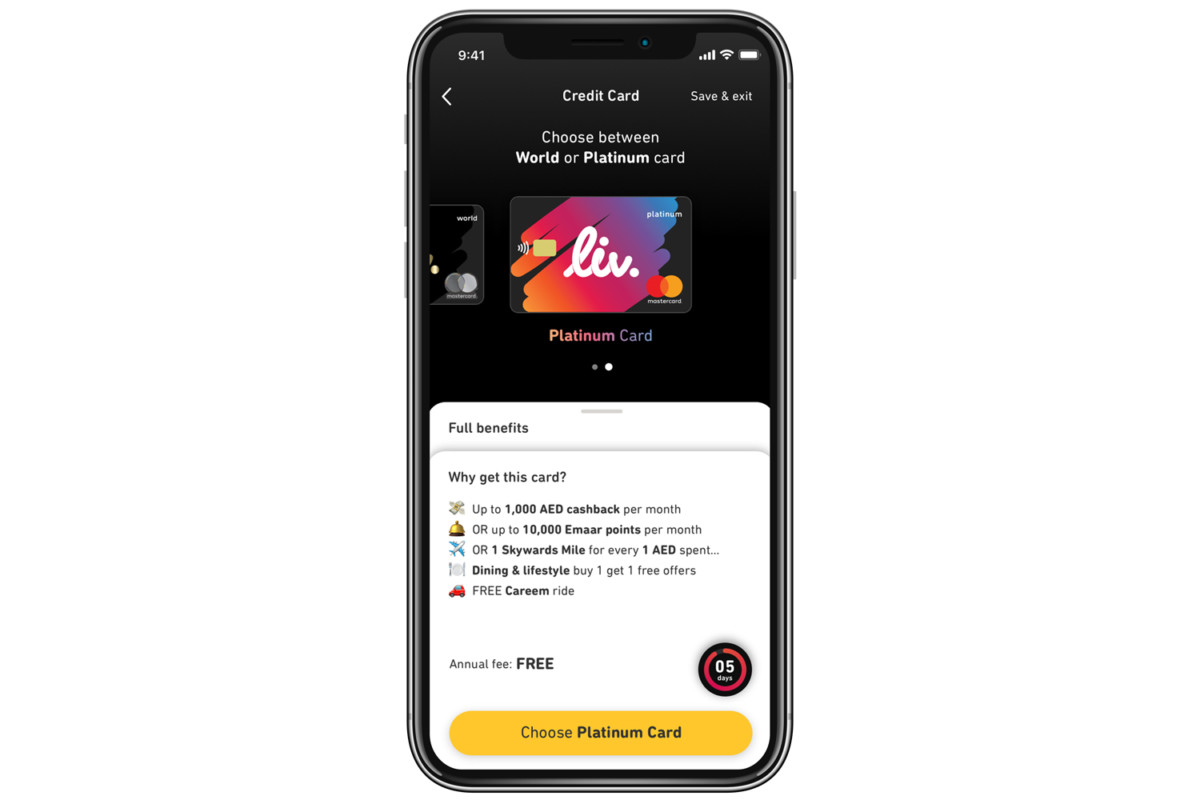

Liv., the digital only lifestyle bank by Emirates NBD, has announced the launch of a unique credit card programme, The Liv. Platinum and Liv. World credit cards.

These cards will offer customers the flexibility to choose and easily switch between reward programmes, as well as obtain significantly higher rewards on spend categories of their choice, along with added lifestyle benefits.

The bank has created a flexible credit card, in partnership with global payments and technology giant Mastercard that caters to the evolving lifestyle needs of its youthful customer base.

Customers can choose to earn rewards in the form of Skywards Miles, U By Emaar points or as cashback. Cardholders can also pick a total of four spend categories – such as dining out, groceries, shopping and others – where they would earn up to 15% of spends as rewards. Liv. customers can sign up for a credit card directly from the Liv. mobile app in a simple and user-friendly process.

Further, customers can also choose from a list of additional benefits to add to the card and pay only for those selected, as well as obtain a range of complimentary benefits.

Suvo Sarkar, Senior Executive Vice President & Group Head – Retail Banking and Wealth Management, Emirates NBD said:

“As a digital bank built by and for millennials, Liv. understands that its customers seek a personalised and custom-built experience including for their banking services. The introduction of the Liv. World and Platinum cards builds on our aspiration to serve as a financial buddy to our customers, by giving them the flexibility to design a credit card that is built around their lifestyle needs. Whether you’re an avid traveler, savvy shopper, or enthusiastic foodie, a Liv. credit card can help you maximize the rewards that make the most sense for you.”